The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company’s operations, financial position, and cash flows. Just as managerial accounting helps businesses make decisions about management, cost accounting helps businesses make decisions about costing. Essentially, cost accounting considers all of the costs related to producing a product. Analysts, managers, business owners, and accountants use this information to determine what their products should cost. In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance. An auditor reviews financial accounts of companies and organizations in order to ensure the validity and legality of their records.

How to Balance Artificial and Human Intelligence in Accounting – CPAPracticeAdvisor.com

How to Balance Artificial and Human Intelligence in Accounting.

Posted: Thu, 17 Aug 2023 22:38:54 GMT [source]

It focuses on logging information, tracking important numbers and quantifying the important monetary aspects of your business. Accounting comes in when these numbers and reports are interpreted and extrapolated to help guide business decisions. Single-entry systems account exclusively for revenues and expenses. Double-entry systems add assets, liabilities, and equity to the organization’s financial tracking. Cash flow (CF) describes the balance of cash that moves into and out of a company during a specified accounting period.

Learn Accounting for Free

This helps investors trust that the information your business presents is accurate. Accruals are credits and debts that you’ve recorded but not yet fulfilled. These could be sales you’ve completed but not yet collected payment on or expenses you’ve made but not yet paid for. Not to be confused with your personal debit and credit cards, debits and credits are foundational Accounting terms to know.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Let us know what type of degree you’re looking into, and we’ll find a list of the best programs to get you there. To obtain CPA licensure, a candidate must meet eligibility criteria and pass a demanding four-part standardized exam.

What Is Accounting? The Basics Of Accounting

With the aim of ensuring compliance with state and federal laws. The political campaign branch of accounting oversees the development and implementation of the finance systems. Each branch has come about thanks to technological, economic or industrial developments. Current or new definitions of accounting, in our perspective, need to recognise and reflect the multi-faceted conception of accounting as a technical, social and moral practice more proactively. We agree that this is a key starting point if accounting is to help shape and create a better world for all forms of life on planet earth. Importantly, this step will also support attempts to depict “what defines the accountant of tomorrow?

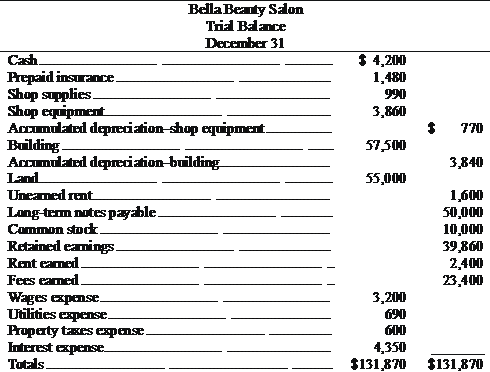

All financial statements, such as a balance sheet and an income statement, must be prepared in a certain way. This tends to be according to the generally accepted accounting principles. Accounting is a term that describes the process of consolidating financial information to make it clear and understandable for all stakeholders and shareholders.

Generally Accepted Accounting Principles

Build an intuitive understanding of finance to better communicate with key stakeholders and grow your career. Designed to help you achieve fluency in the language of business, CORe is a business fundamentals program that combines Business Analytics, Economics for Managers, and Financial Accounting with a final exam. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Instead of recording a transaction when it occurs, the cash method stipulates a transaction should be recorded only when cash has exchanged. Because of the simplified manner of accounting, the cash method is often used by small businesses or entities that are not required to use the accrual method of accounting. Cost accounting is often a prerequisite of managerial accounting because managers use cost accounting reports to make better business decisions.

Examples of Management Accounting

Small business accounting software has made big advancements as more people take the entrepreneurial path. A skilled CPA will save you time by communicating your company’s financial state to you in clear language, while anticipating your financial needs. As your business grows, it can be difficult to keep track of all your tax information reporting obligations.

The four largest accounting firms globally include Deloitte, KPMG, PwC, and EY. The role of an accountant is to responsibly report and interpret financial records. Accounting is important as it keeps a systematic record of the organization’s financial information. Up-to-date records help users compare current financial information to historical data. With full, consistent, and accurate records, it enables users to assess the performance of a company over a period of time. Whereas you might only periodically consult your accountant, a bookkeeper touches base more frequently and handles daily accounting tasks.

Accounts Receivable & Accounts Payable

They are generated in a way to help managers analyze past decisions and plan for the future. Forensic accountants need to reconstruct financial data when the records aren’t complete. This could be to decode fraudulent data or convert a cash accounting system to accrual accounting. Forensic accountants are usually consultants who work on a project basis.

To accountants, the two most important characteristics of useful information are relevance and reliability. Information is relevant to the extent that it can potentially alter a decision. Relevant information helps improve predictions of future events, confirms the outcome of a previous prediction, and should be available before a decision is made. Reliable information is verifiable, representationally faithful, and neutral. The hallmark of neutrality is its demand that accounting information not be selected to benefit one class of users to the neglect of others. While accountants recognize a tradeoff between relevance and reliability, information that lacks either of these characteristics is considered insufficient for decision making.

Professional bodies

Check out our review of QuickBooks accounting software and our Zoho Books review for examples of top software providers. If accounting isn’t one of your strengths but you have to manage this aspect of your business, there are numerous tools on the market that can help you. And the best place to start is by investing in accounting software.

- These systems can be cloud based and available on demand via application or browser, or available as software installed on specific computers or local servers, often referred to as on-premise.

- We also explain relevant etymologies or histories of some words and include resources further exploring accounting terminology.

- Once you have a set process for documenting and reporting your finances, stick to it.

- Tolerating tired or outdated technicist definitions of accounting does not project a vibrant, forward-looking profession operating in the difficult early 2020s global conditions.

- You’ll also learn how to evaluate this objective evidence and use established procedures in order to formulate a judgment and communicate this through an audit report.

It’s the perfect report to review to make sure you have the cash available to tend to your debts and plan future payments. When a customer owes you money, it appears as Accounts Receivable (AR) on your balance sheet, which is generated automatically by your accounting software or manually by you or your accountant. Keeping up with your accounting helps you stay on top of your business finances. That information is essential to assess how quickly your business is developing and guide future decision making. Without accurate reporting, you won’t have the full financial picture. On a cash basis, you only record transactions when money changes hands.

Financial statements need to be transparent, reliable, and accurate. Accounting is the practice of tracking your business’s financial data and interpreting it into valuable insights. This allows you to generate crucial financial statements, such as a balance sheet, cash flow statement, and profit and loss report. It sounds simple, but in reality, a lot of behind-the-scenes work goes into accurately reporting on a business’s financial state. Accrual basis accounting (or simply “accrual accounting”) records revenue- and expense-related items when they first occur. Accrual accounting recognizes that $2,000 in revenue on the date of the purchase.